The Achilles Heel of the ‘Computer on Wheels’ Myth

Is a software-defined vehicle (SDV) a “computer on wheels,” as its promoters claim? If so, where is its networking backbone? If it’s got one, what is it?

(Source: Teledyne LeCroy)

Before I broach this conundrum, allow me to share my distaste with the very concept of a “computer on wheels.” More than a decade ago, when the marketing wizards of high-tech coined the phrase “computers on wheels” (or—worse—“smartphones on wheels”), I thought, well, clever.

Here was the catchphrase for a new generation of automobiles.

Over time, I’ve come to regard the term as cheeky, hackneyed and even dangerous — for two reasons.

First, when you call a car a computer, you can shrug off software glitches as normal events. However, with a decline in reliability, accuracy, and safety in highly automated vehicles (ADAS, AVs), consumers are noticing signs of the abnormal.

Second, when you invoke the nickname, “computer on wheels,” you have to ignore a few fundamental facts. Most cars today are not designed as computers. There are electronics inside, but they are spread throughout the vehicle in 150 or 200 of isolated ECU boxes.

Worse, the boxes are not designed to talk cohesively with one another. Each is on a different communication network using different protocols. The Achilles heel of this synthesis is that no single networking backbone unites the vehicle.

Put simply, current-day vehicle architecture bears no resemblance to a computer.

Car = Battery + Computer

Nevertheless, the advent of the SDV has revived talk of “computers on wheels.”

This time around, though, the automotive industry is tweaking the definition of SDVs with substantial architectural changes, instead of promoting “computer on wheels” as marketing buzz.

Right now, the front-runners in the SDV race are not traditional OEMs wrestling to reconfigure their non-computer vehicle architecture into SDVs. The smart money is on China’s EV makers, who intuitively see vehicles as computers.

At the Shanghai Auto Show, opening this week (April 23), expect to hear about Chinese carmakers embracing their next-generation E/E architecture.

Chinese players already see their EVs as “computers” with “batteries,” observed Jack Weast, vice president and general manager of Intel’s automotive business unit. Chinese vendors see that the difference that distinguishes their EVs isn’t brakes, steering and transmission. It’s computers and batteries.

Weast recalled that at last year’s Shanghai Auto Show, he heard Chinese carmaker Changan (headquartered in Chongqin) pitching its new battery EV, Changan Nevo E07, by talking up “the Time-Sensitive Network (TSN) gigabit Ethernet.”

“I don’t know if I’ve ever seen an automaker elsewhere talk about what kind of wired networking protocols they are using as the foundation of their vehicle,” said Weast.

Networking backbone for SDVs?

Over-the-Air update is the most talked about SDV building block.

But other SDV elements include a transition to domain, zonal controllers, and central compute E/E architecture. These are keys for OEMs to consolidate hundreds of ECUs into a handful so that they can develop SDVs that are both cheaper and more power-efficient.

Another SDV building block, less discussed but vital, is Ethernet as the backbone.

Why?

Without a comprehensive networking backbone, it’s difficult to balance or shift the workload of vehicle functions.

In theory, an SDV is expected to eventually function much like data centers that manage operations by switching and balancing workloads among servers or racks.

But the crucial point is that while the deployment of gigabit Ethernet in SDVs seems inevitable, it does not currently provide a comprehensive networking backbone. It is used only in pockets to enable domain-specific applications.

Ian Riches, global automotive vice president at TechInsights, observed that gigabit Ethernet is “mainly used by those OEMs (e.g. Tesla) who have been quickest in embracing more centralized architecture.”

TechInsights’ teardowns also show several Chinese models already using gigabit Ethernet, said Riches. But in most cases, their job is domain-specific connectivity. “The usage we’ve found has been in ADAS or cockpit domain controllers, as well as some lidars,” he added.

Jumble of wires

As most observers acknowledge, in-vehicle networking is thus far a dog’s breakfast. Vehicles are deployed with a jumble of disparate wires running different protocols.

This is the result of years of haphazard practices by feature-addicted carmakers who kept piling on ECU boxes —for ADAS, infotainment, displays, vehicle controls, gateway, autonomous ECU, and central computing.

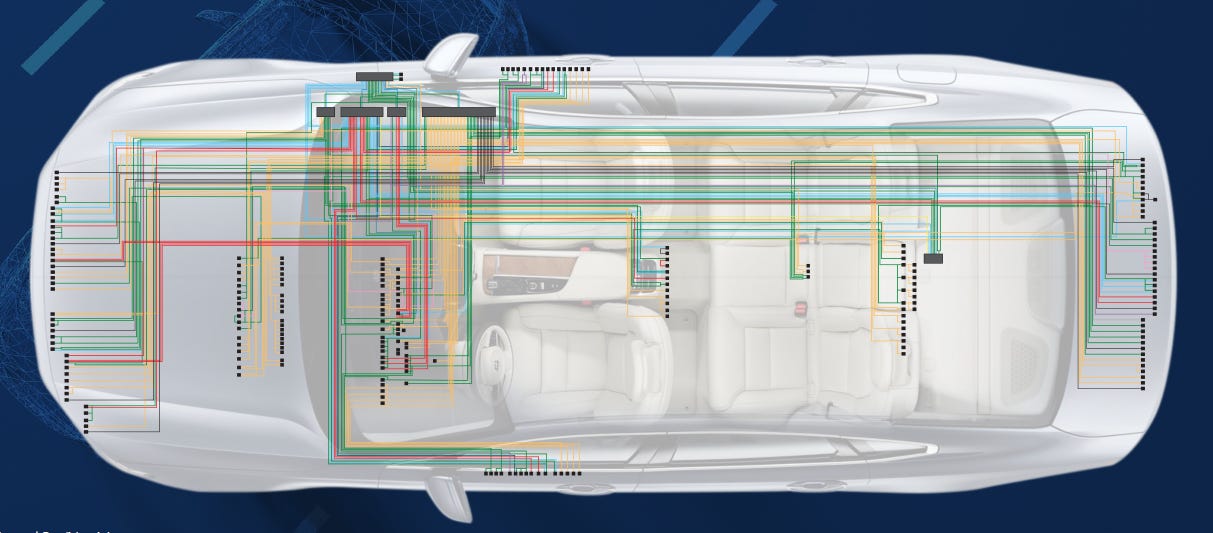

As the image below shows, the network technologies inside a vehicle include CAN bus, LIN bus, LVDS, MOST, Ethernet, PCIe, and a few proprietary additions.

Today’s vehicles implement multiple connection technologies and networks (Source: Ethernovia)

Christopher Mash, vice president of business development at Ethernovia, explained:

The lines in different colors indicate different technologies. CAN bus in yellow, Ethernet in green, LIN bus in red, MOST in blue, LVDS in darker red, for example.

If you look at where a driver is sitting, you'll find at least five different wires, all going back to the domain controllers, illustrating such inefficiency and complexity in the wiring of the architecture.

Mash highlighted a real issue. “If you want a connected vehicle [SDV] in which I can change the operation of some of these features, I now need my computers, my SOCs or my CPUs inside a vehicle to be able to see all the data in the car … So how can I do that?”

Without a comprehensive networking backbone, SDV is the impossible dream.

OEMs created this complexity. They “just kept adding another [network] technology, without removing the previous technologies. They keep laying stuff on top,” Mash lamented.

Moving targets

Today, networking technologies in vehicles are advancing but still in flux.

Richard Dixon, senior principal analyst for automotive sensors at S&P Global Mobility, acknowledged that most OEMs, who have advanced their vehicle architecture to zone controllers, “are using 1000 Mbps to connect the big ADAS and infotainment controllers together.”

He explained, “Some are faster, such as 2.5 Gbps, but the majority have centered on 1 Gbps as a good compromise of performance vs cost.”

In parallel, higher speed data links (such as cameras) use LVDS (Low-Voltage Differential Signaling) or other proprietary links direct to ECUs when connecting the autonomy ECU to fuse data from camera, radar and/or lidar. “These are more than 10 Gbps and would not be economical for in-vehicle networks.”

He added, “in China and Japan, most OEMs who need high speed communication links are using CAN-FD (Controller Area Network with Flexible Data Rate) as backbone links to avoid the higher costs of Ethernet cables. But Tesla also uses CAN-FD and only moved to Ethernet backbone ring recently on the Cybertruck.”

Infineon’s move

Against this backdrop, Infineon Technologies announced this month plans to acquire Marvell’s automotive Ethernet business. The German automotive MCU giant called Ethernet connectivity solutions “vital to software-defined vehicles,” and “the basis for highly efficient E/E-architectures comprising central compute, zones and endpoints.”

This move fills a gap in an Infineon product portfolio that had no automotive Ethernet. It will give the company access to more than 50 automotive Ethernet customers already cultivated by Marvell.

A spokesman said that Infineon plans to “combine Marvell’s Automotive Ethernet technology with our market-leading portfolio of microcontrollers to create a comprehensive portfolio of real-time control and communication solutions.”

The question remains. How can Infineon keep pace with rapidly evolving Ethernet standards, along with other proprietary network solutions that are all gunning for asymmetrical links?

Asymmetrical networking

For all current uses in cars, symmetric Ethernet is required to support full duplex communication at high speeds between a vehicle’s ECUs.

In contrast, camera sensors and displays are now using asymmetrical connections. “Asymmetrical links are most useful for sensors, where the data flows at a high rate from the sensor to the controller, but a much lower bandwidth back channel for control signals is needed,” TechInsights’ Riches explained. “Running a full symmetrical link where it is not needed can waste power.”

Several proprietary solutions already in use in the gigabit range include: GMSL (developed by Maxim, now ADI), FPD-Link (National, now TI), and APIX (Inova).

“GMSL is probably the leader, especially if we are talking about connecting ADAS sensors,” according to Riches. FPD (flat-panel display)-Link and APIX (Automotive Pixel) Link are more targeted at displays, he explained.

Conceding OEMs’ aversion to proprietary solutions, two different standards-based asymmetric solutions, Automotive SerDes Alliance (ASA) and MIPI A-PHY, are coming to market.

ASA is a consortium of auto tech companies seeking to advance standardization of asymmetrical, high-performance SerDes (serializer/deserializer) technology for broadband connection of sensors for autonomous driving.

MIPI A-PHY is targeted for ADAS, autonomous driving systems, in-vehicle infotainment (IVI) and other surround-sensor applications.

So, where does this leave Ethernet?

Ethernovia’s Mash noted, “OEMs have taken this to the next logical step and have said, as we are already moving to Ethernet, let’s make all connectivity Ethernet.”

Hence, there’s a new IEEE group called 802.3dm, tasked with creating asymmetrical Ethernet links for Sensors and Displays.

According to Riches, “Expected date of submission of draft to the IEEE SA for initial Standards Committee ballot is November 2025.” The projected completion date for submission to Committee Review is November 2026.”

With 802.3dm, “OEMs are really trying to find a homogeneous network,” observed Mash.

Companies that test the electrical quality of the signal using oscilloscopes and other tools, such as Teledyne LeCroy, support testing of both the classic standards (CAN, LIN, etc.) and the more recent automotive ethernet and automotive SerDes standards.

Thomas Stueber, product marketing manager of Teledyne LeCroy, noted, “In-vehicle network architectures are rapidly transforming from the classic (nodal) to domain and (future) zonal architectures, and this is driving rapid adoption of higher-speed and multi-purpose serial data standards. We at Teledyne LeCroy work to support testing of all new standards until the market selects the winning technologies.”

Wanted: Scalability

With so many networking technologies co-existing in vehicles, OEMs need a comprehensive networking backbone, preferably Ethernet, that can scale from one-gig to multi-gig, and symmetrical to asymmetrical. They need solutions that can intelligently interface with legacy ECUs, aggregating and accelerating and ensuring deterministic data transport. After all, OEMs would not replace traditional communication links like CAN and LIN with Ethernet. The legacy links will remain in vehicles.

Ethernovia hopes to fill in many such check boxes.

The startup already announced its multigig PHY. Unlike solutions by Marvell or Broadcom, Mash claimed, “Our multigig Phy can also support one gig operation. In a steppingstone manner, an OEM can use a single device from us to connect to a legacy ECU at one gig or move that into a more like mid or premium architecture, where that link can operate at 2.5 or 10 gig.”

Ethernovia hopes to provide scalability with much lower power drain. Adopting TSMC’s 7nm process technology, Ethernovia claims an edge over the competition in power consumption and heat dissipation.

The emergence of new standards like 802.3dm is promising. But industry analysts in the West are cautious. Phil Amsrud, associate director, Automotive at S&P Global, said, “I suspect it’ll take longer than it seems like it should. That doesn’t mean Ethernet will take that long to get adopted. But if history indicates anything it’s more likely that each OEM will do their own thing, at least initially.”

Ethernovia sees the issue shaking out differently in China, where interest for scalable multigigabit Ethernet is scaling up. Mash is on route to the Shanghai Auto Show this week, his third trip to China in six weeks.

Nice read, to me an important step will be also the adoption of RCP to deal with the end nodes. Safe travels to Chris!